How to re-engage with the changed customers

Downturn period and covid make your customers less able and less willing to spend than before.

The coronavirus shock has disrupted more than jobs, supply chains, and financial markets. Your customer has changed fundamentally, too.

The number one task for many companies now is discovering where their B2C and B2B customers have moved to and re-engaging with them.

COVID-19 is a different beast than recent economic crises and recessions such as the Great Recession of 2008 and the Mideast oil crisis, whose causes were financially driven. The fundamental driver of the pandemic is health and safety concerns and hence customer driven. Customers’ immobility and desire to be safe in the current environment has resulted in volatility in purchases and productivity across idiosyncratic product categories, resulting in a net economic crisis of a type that has not been witnessed by anyone alive today.

Government-imposed quarantines, self-isolation, and closures of stores and offices have further forced changes to customers and hence firm-based behaviors. The outcome of customers’ health and fears has resulted not in a traditional recession but a “deaccession,” where supply and demand exist, but customer-access to products and services has been significantly shut off.

All in all, this set of circumstances and stricter budget constraints make customers less able and less willing to spend compared to past recessions. How will you find them? How will you engage them?

What is clear in the COVID-deaccession is that this change in customer behavior is pushing firms into a new “directional reality.” Firms need to adapt to shifting customer wants by engaging a more customer-centric philosophy. Rather than expecting their customers to come to them, they need to go to their customers.

Past research demonstrates that firms who maintain or accelerate customer-centric philosophies consistently outperform firms that do not. In fact, they gain market share from competitors who cut back on customer-centric investments.

During this COVID-deaccession, it is even more critical for firms to become more customer centric by researching and understanding their customers’ new problems caused by fear, isolation, physical distancing, and financial constraints, and attempt to structure their offerings to meet these new unmet wants and needs.

The velocity or rate of adaption that firms need to adjust to a new directional reality will depend on customer demand. Industries with decreasing customer demand—offline entertainment, hospitality, real estate, industrial commodities, and suppliers to these industries—need to adjust rapidly to give them a better chance of surviving.

In contrast, industries with increasing customer demand—grocery stores, online entertainment, teleconference providers, and their suppliers—need to adjust to this directional reality at a slower, yet definitely needed, pace to help sustain growth for the longer term.

Whether industries are experiencing decreases or increases in demand, all firms and organizations need to take a step back or forward and ask themselves: What should be my minimally viable strategy to get through these unprecedented times?

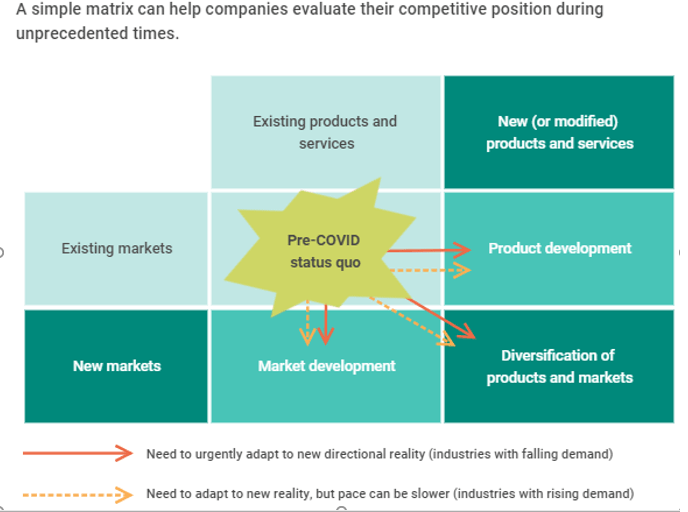

To adapt to a new customer-centric directional reality, Rohit Deshpandé from Harvard proposes an alternative to Ansoff's (1965) growth strategy matrix (see table below). The proposed 2 x 2 matrix is categorized by whether the firm is competing with existing versus new or modified products and services, and whether it is competing in current or new markets (i.e., new customers and/or new geographies).

First Quadrant: Firms stay in the status quo or pre-COVID situation. As discussed earlier, times have changed, and business cannot be run as usual. Firms must go to their customers instead of just relying on their customers coming to them. Thus, maintaining the status quo or first quadrant behavior is not advised. We need to go beyond status quo in the new abnormal.

Second Quadrant: Firms create new products or services. Firms may consider adding new services or tiers of products that meet customers’ deaccession-based basic unmet needs. Walgreens allowed customers to purchase a number of products at their drive-through because of their fundamental utilitarian-based health and safety needs. TechSee is providing European organizations free access to their artificial reality (AR) annotation products on mobile phones. AT&T, Cisco, and Zoom have enhanced their network capabilities for increased demand in bandwidth. In addition, numerous small businesses like restaurants and home goods retailers try to match increased demand by allowing customers to purchase by email, messaging services, or phone orders. While the first quadrant, or status-quo, is dead, the new normal is the second quadrant.

Third Quadrant: Firms expand into new customer markets with their existing products or services. For many companies, demand in the first quadrant has dropped sharply—they must find new markets to grow. Hence, American, Delta, and United Airlines are now employing airplanes previously targeted for passengers to fulfill cargo deliveries. For some firms, their products or services are now useful and in demand by new customer bases. Cintas is expanding its business-cleaning offerings to new markets to match new demands and unmet needs. Zoom removed time limits from basic accounts for primary school educators who now need to use its teleconferencing software for teaching. Fan Interactive Marketing, which provides customer relationship management and digital marketing tools for entertainment venues and sports teams (largely unused during the pandemic), switched to targeting small- and medium-sized traditional businesses struggling to survive.

Fourth Quadrant: Firms diversify simultaneously into both new markets and new products and services. Firms whose customer demand for their core products and services has decreased need to find new customers for new products and services in segments experiencing steep increases in demand. Thus, Dyson, GM, Ford, Volkswagen, and Tesla attempted to produce ventilators for hospitals, British Honey Company is making hand sanitizers, and Louis Vuitton, Nivea, and Zara are making surgical masks, disinfectants, and other medical-related devices.

by Alessio De Filippis, Founder and Cheif Executive Officer @ Libentium.

Founder and Partner of Libentium, developing projects mainly focused on Marketing and Sales innovations for different type of organizations (Multinationals, SMEs, - Start-ups).

Cross-industry experience: Media, TLC, Oil & Gas, Leisure & Travel, Biotech, ICT.

Read more: