Libentium Growth Program ®

Every growth strategy needs

resources

We assist the C-suite to get the company "Funding-ready" and manage the E2E IPO project.

We support SMEs and startups in accessing the US capital market through our framework that mix financial advisoring, investment banking and management consulting services.

Thanks to the partnership with Emintad we can support our clients that want to access to OTC Market Capital with E2E services.

We support our clients on handling the opportunity to be listed on OTC markets, managing IPO projects for established enterprises, spinoffs and startups.

Libentium Growth Program in a Nutshell

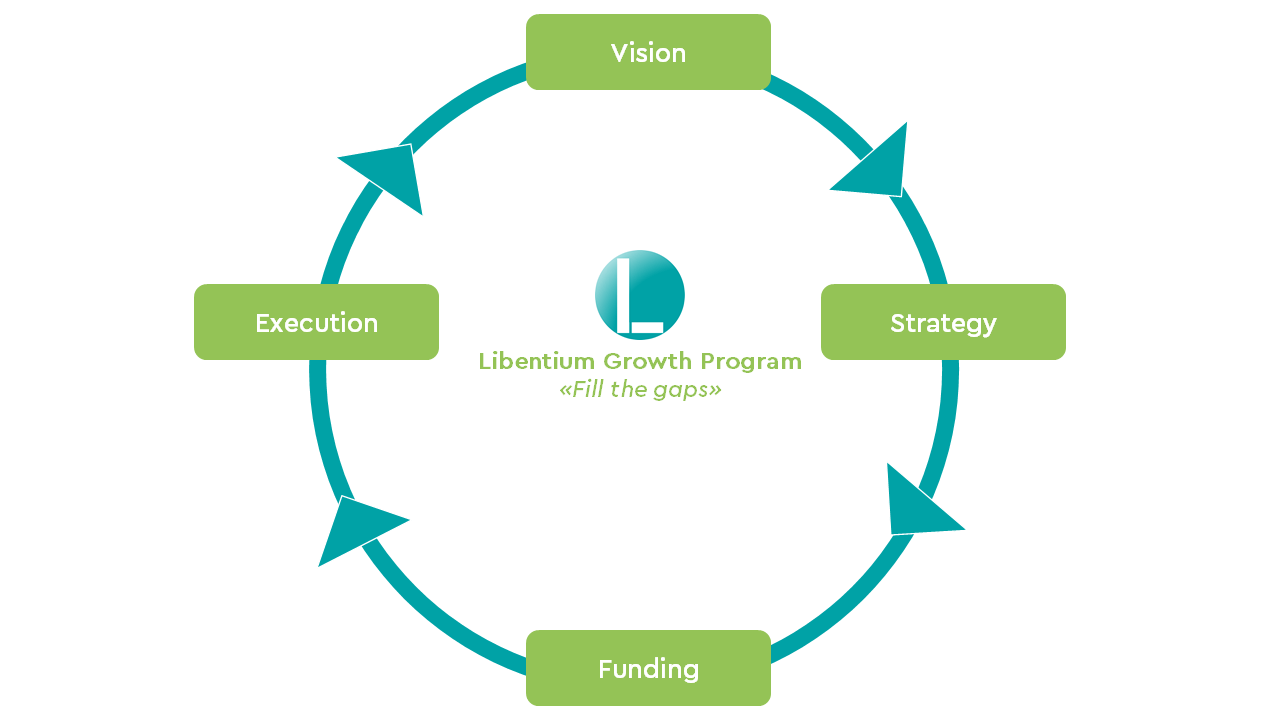

Creating value means funding visions , in other terms means defining goals, delivering a strategic plan, collecting and allocating resources in a long-term period of sustainable growth. Our framework is designed for supporting organizations through the growth path that means coordinate vision, strategy, funding and execution.

Financing is the fuel for scaling your business and the Growth Program is designed to give you the capabilities to do this.

We co-create technology-enabled, disruptive strategies that win competitive advantage, unlock value and drive profitable growth for clients and support the clients in funding process.

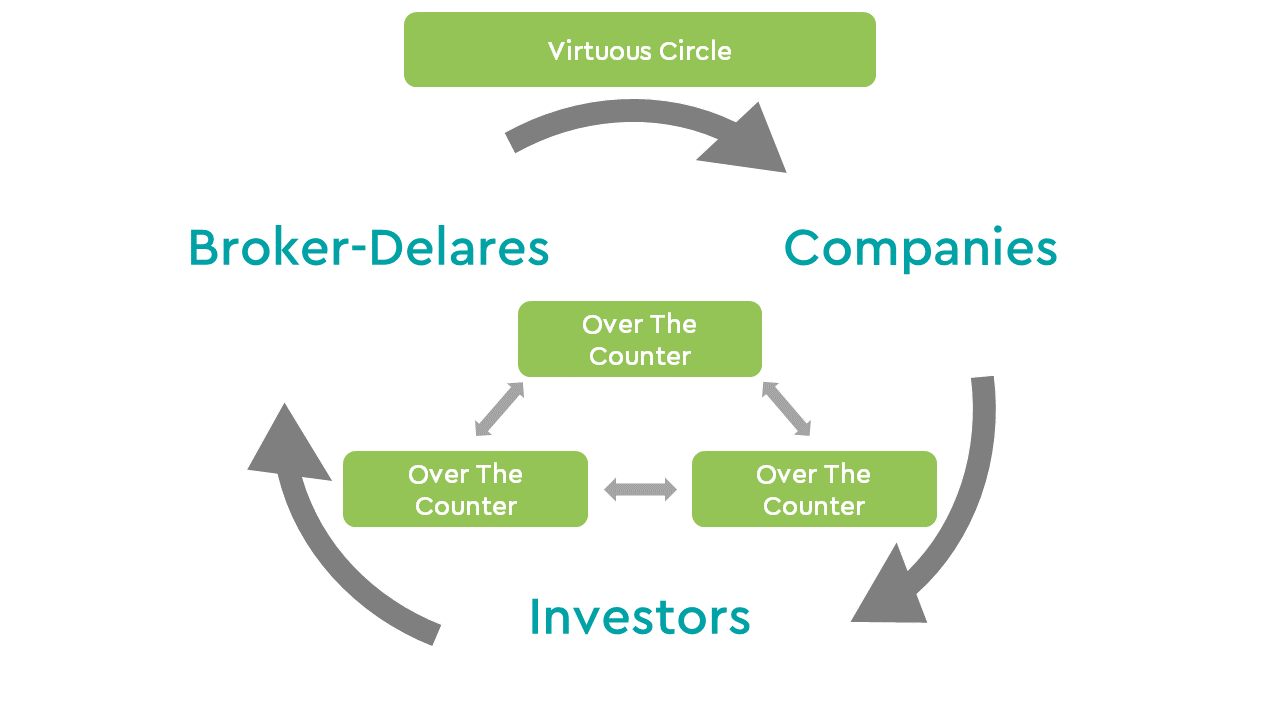

We deliver strategy and operations consulting services for every startups and SMEs with enough ambition. We deliver financial advisory and management consulting services that fulfill the gaps in every part of the organization to foster the virtuous circle of creating value.If you have a growth strategy, you need funding, you need to collect resources, use them for creating value, demonstrate that you deserve additional resources and so on. We follow the clients through the path and prepare them for funding activities and mostly for the final goal that is the IPO on OTC capital markets that means funding the additional boost of enterprise growth. It's a virtuous circle of boosting ambitions, having instruments to fulfill the ambition, funding the ambition, executing the vision.

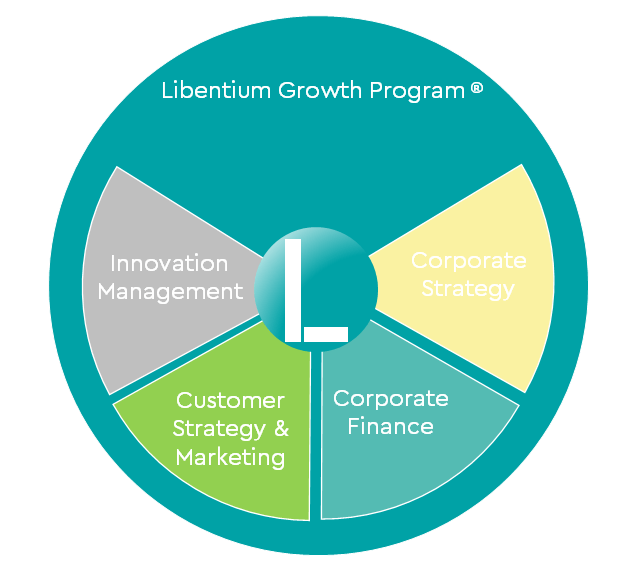

Libentium Growth Program ® is a mix of different tools and services:

- Corporate Strategy;

- Corporate Finance;

- Customer & Market Strategy;

- Innovation Management.

The mission is delivering all the service in terms of Strategy and Operations needed to build an

IPO-ready organization.

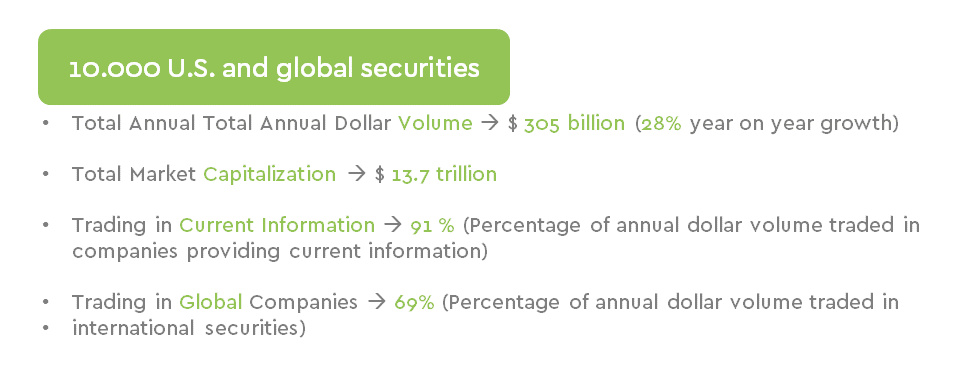

Most important advantages of OTC Markets concern trading and operational benefits as shown below:

The U.S. Opportunity

The United States capital markets offer a tremendous opportunity for growth and expansion to startup companies as well as long established companies and especially for international companies wishing to gain access to the American capital market.

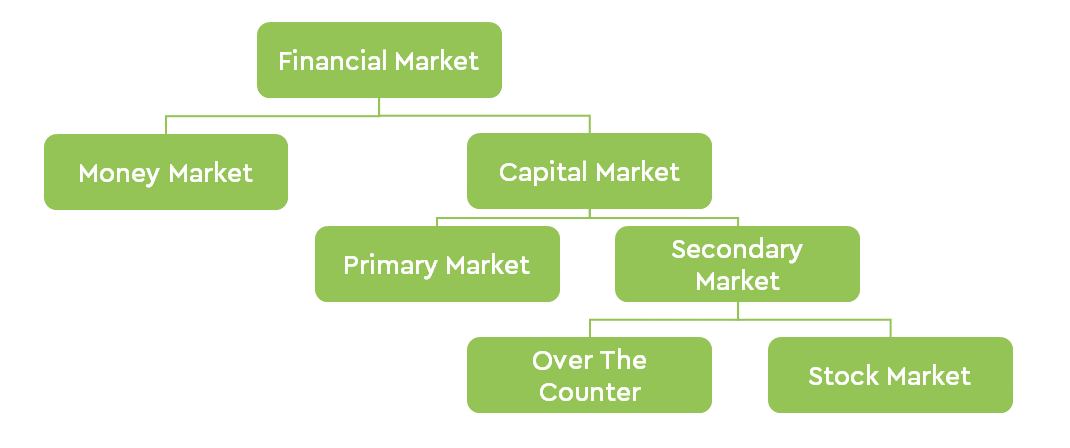

For a company, one of the easiest and fastest way to be listed in U.S. is by listing on the OTC (Over the Counter) market, which is a fully electronic interdealer quotation system affording investors and broker dealers access through online and full service brokerage firms in the U.S. or on the NASDAQ stock market (Capital Market segment), the world’s largest electronic stock.

The U.S. public market provides an impressive marketing opportunity for International issuers to expand their shareholder base:

- 48% of the world’s assets are managed in the US;

- 2/3 of the world’s hedge funds;

- 5,500 investment managers;

- 635,000registered securities reps;

- 4,100 brokerage firms.

OTC Markets Group Inc.

OTC Markets Group Inc. (OTCQX: OTCM) operates three financial marketplaces: OTC QX ®, OTC QB ® and OTC Pink ® Through OTC Link® ATS, we directly link a diverse network of broker dealers that provide liquidity and execution services for a wide spectrum of securities.

What is an OTC Offering?

An OTC Offering ” means taking a private company into the public marketplace. In an offering transaction, a private operating company becomes SEC reporting and eligible to raise capital from U.S. and International institutional and, in some cases, retail investors.

An Offering Transaction avoids the time constraints, legal costs and disclosure requirements of traditional listing on major markets such as Nasdaq or New York Stock Exchange.

OTC Vs Traded Securities

Over The Counter (OTC) or off –exchange trading allows to trade financial instruments such us stocks, bonds, commodities or derivatives directly between two parties without going through an established exchange (ie. Nasdaq or Borsa Italiana).

- The contract between the two parties is privately negotiated.

- OTC main players are Investment Banks and Swap Dealers and include Financial (hedge funds, commercial banks, etc.) and Non-Financial Institutions like governments, municipalities or corporations.

- Main advantages of OTC compared with regulated exchanges are that contract specifications are tailor made and costs are lower.

+39 393 86 27 776

info@libentium.com

Libentium © is a brand of Libentium LLC

© 2023 Libentium LLC All rights reserved